HUMANS

helping you achieve

peak performance

At Humans we help you achieve your state of peak performance.

Peak performance is unique to us all; whether just starting on our journey of optimising cognitive functioning, or have been biohacking our bodies for the last decade, our individual peak performance is the place in which we grow.

Sharing with you our Pillars of Peak Performance, we help you understand why mastering each component is critical to activating your centre of peak performance.

We become our best selves when we can master our minds and optimise cognitive functioning far beyond that of our peers | Start your Peak Performance journey here

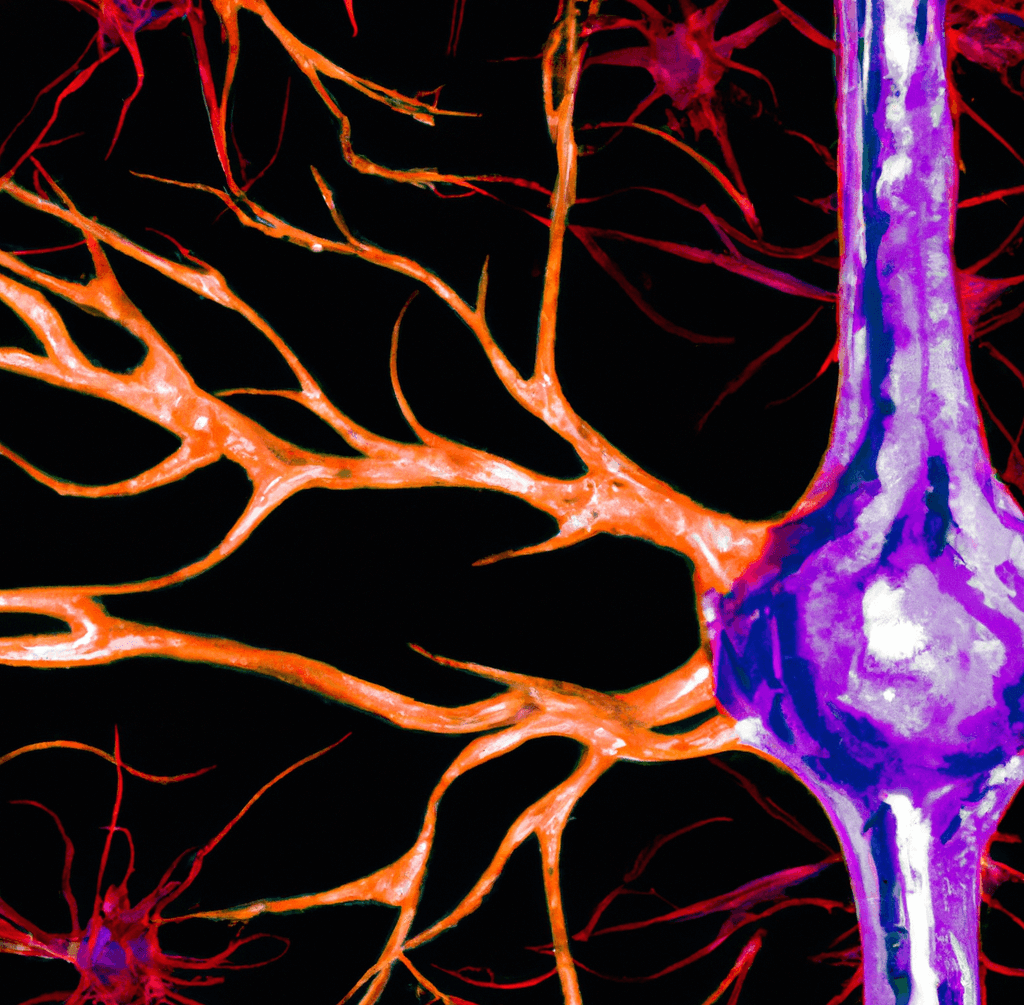

Biohack your Brain

See the full page of self-optimisation strategies here | Biohack your Brain.

Norepinephrine

Norepinephrine precursor supplements help you achieve heightened states of focus and attention | Read all its benefits here

Phosphatidylserine

Phosphatidylserine significantly increases cognitive processing speed, and memory, while also improving brain health through brain cell maintenance and repair l Read all its benefits here

Anandamide

Also known as The Bliss Molecule, anandamide is the feel good supplement that helps release waves of serotonin throughout your body l Read all its benefits here

Quercetin is fast becoming a super supplement for brain health and the cardiovascular system. Being able to pass through the blood-brain barrier, it is one of the rare compounds that can interact directly with brain cells and provide antioxidant protection within the brain itself, while also improving blood vessel health, lowering blood pressure, and clearing unhealthy cholesterol | See the best Quercetin supplements for 2024

Biohack your Body

See the full page of self-optimisation strategies here | Biohack your Body.

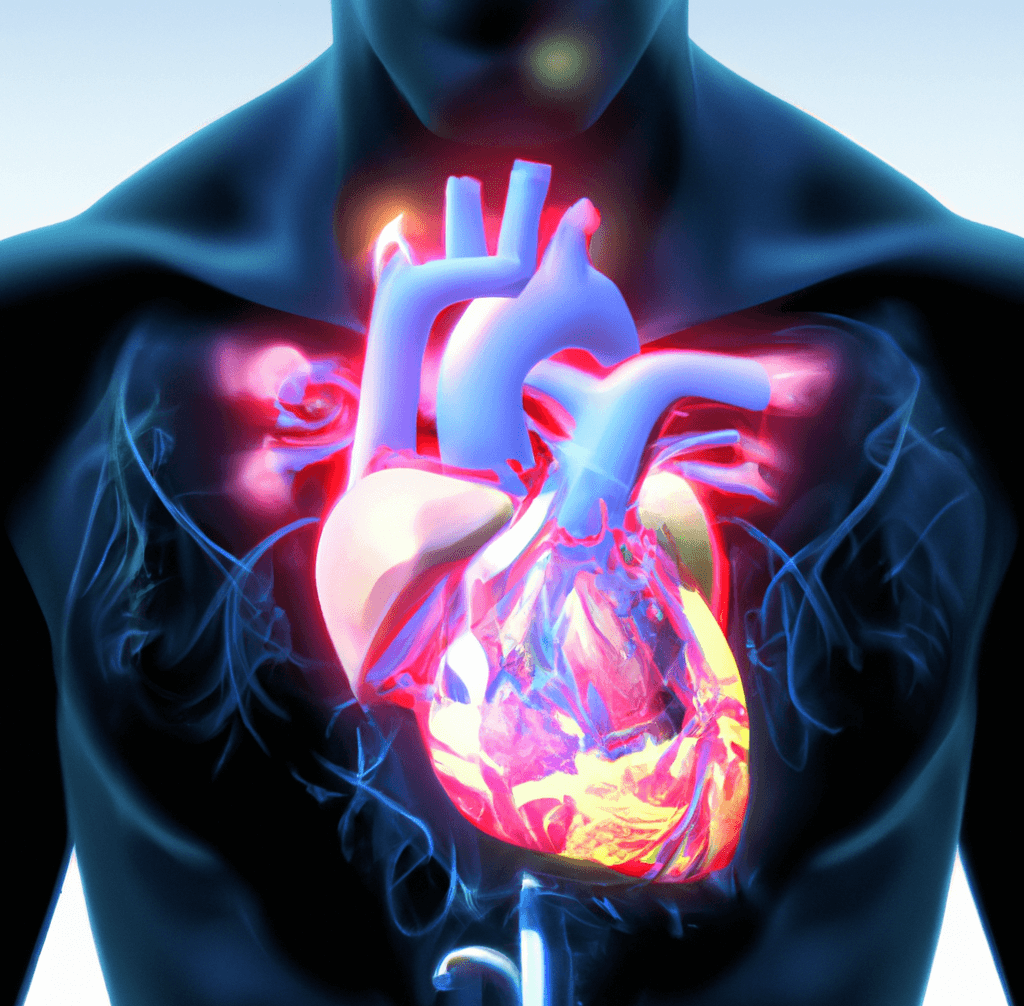

Heart Rate Variability | improves overall heart rate

A strong heart rate variability builds stress resilience, lowers the risk of heart disease, and improves training recovery | Read all its benefits here

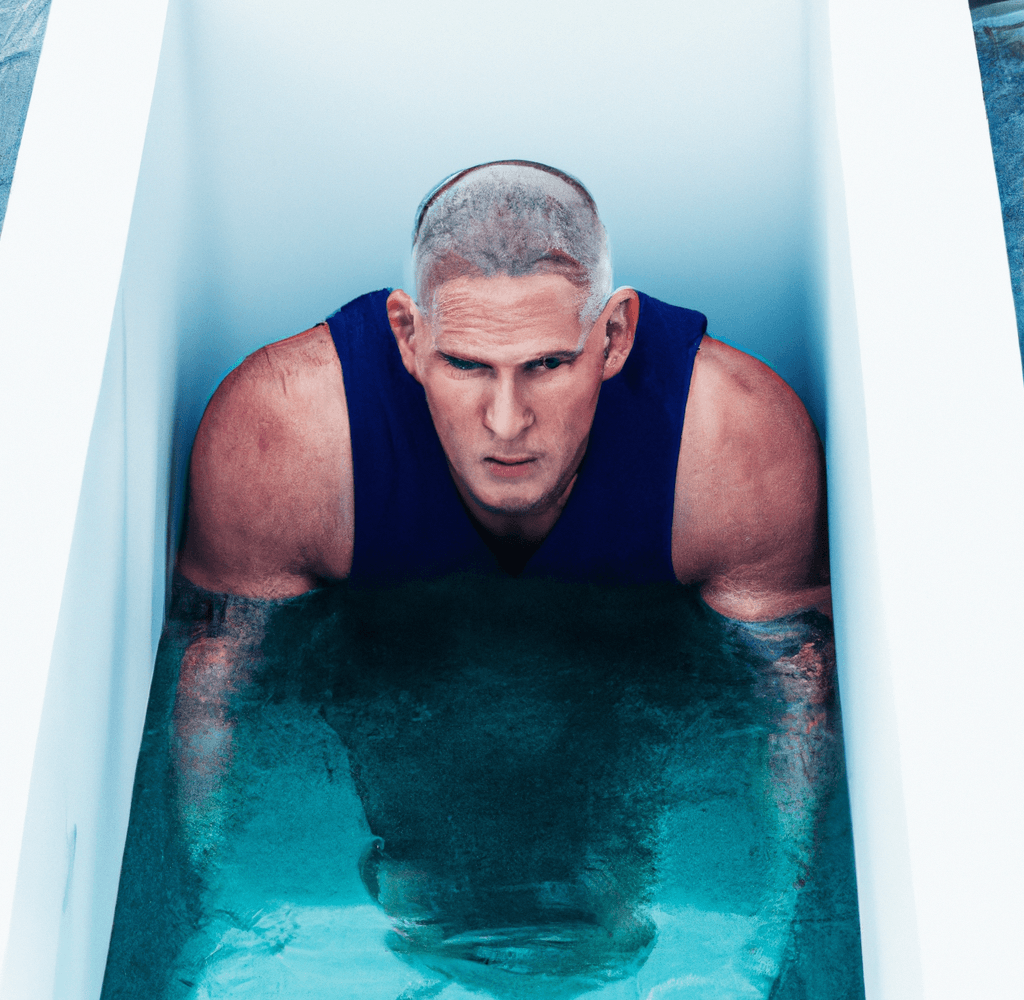

Sauna to Ice Plunge | improves resting heart rate

The rapid shock response from a sauna to ice plunge gives you immediate cognitive alertness and mental performance | Read the article here

Red Light Therapy | activates natural cellular recovery

Red light therapy is a natural treatment which activates the skin’s natural cellular healing process | Read all its benefits here

Best NMN Supplements 2024

There is a reason NMN supplements are promoted as the longevity supplement. A precursor for the production of NAD+, a critical molecule for maintaining healthy cells and key biological processes, NAD+ is critical to keeping our internal system young and operating efficiently. As we age, NAD+ levels decline, leaving us susceptible to age-related health conditions. NMN, therefore, maintains NAD+ production levels, preventing the aging process and age-related decline. | See the best NMN supplements for 2024

Reverse Age-related Damage

The elixir of eternal youth, NMN supplements can reverse the damaging effects of cellular aging | Read NMN’s benefits here

With its ability to aid cell growth, repair, and regeneration, it’s believed spermidine promotes cellular longevity | Read all the benefits here

Fast becoming known as the ‘longevity’ supplement, it is being taken for reversing cellular aging | Read fisetin’s benefits here

A ground-breaking supplement but hard to get your hands on, rapamycin is reversing cellular aging | Read rapamycin’s benefits here

Biohack Stress

Alleviating anxiety, depression, and creating new levels of cognitive clarity, rhodiola rosea is nature’s best kept secret l Read all its benefits

The super-root with anti-inflammatory properties that reduces stress, anxiety, and alleviates depression | Read the article in full here

Consumed for centuries for its anxiety reducing properties, passionflower is the calming supplement we all need | Read all its benefits here

Using natural alternatives to Xanax is key to preventing physical and psychological dependence on the drug | Read the article here

Biohacking with Mushrooms

Lions mane supplement is fast becoming known as the fungi for elevating cognitive performance to superior levels | Read the full article here

Chaga mushroom is the fungi fighting the nasties inside you. Packing punch for your immunity, it has superior qualities | Read the full article here

Cordyceps is quickly taking hold as the supplement improving stamina in fitness and people’s sex lives | Read the full article here

Fast becoming known for inducing quality sleep, reishi mushroom can bring the central nervous system to stillness, calmly, and quickly | Read the article in full here